IoT, Insurance, Risk Mitigation

IoT and insurance: a goldmine for risk mitigation

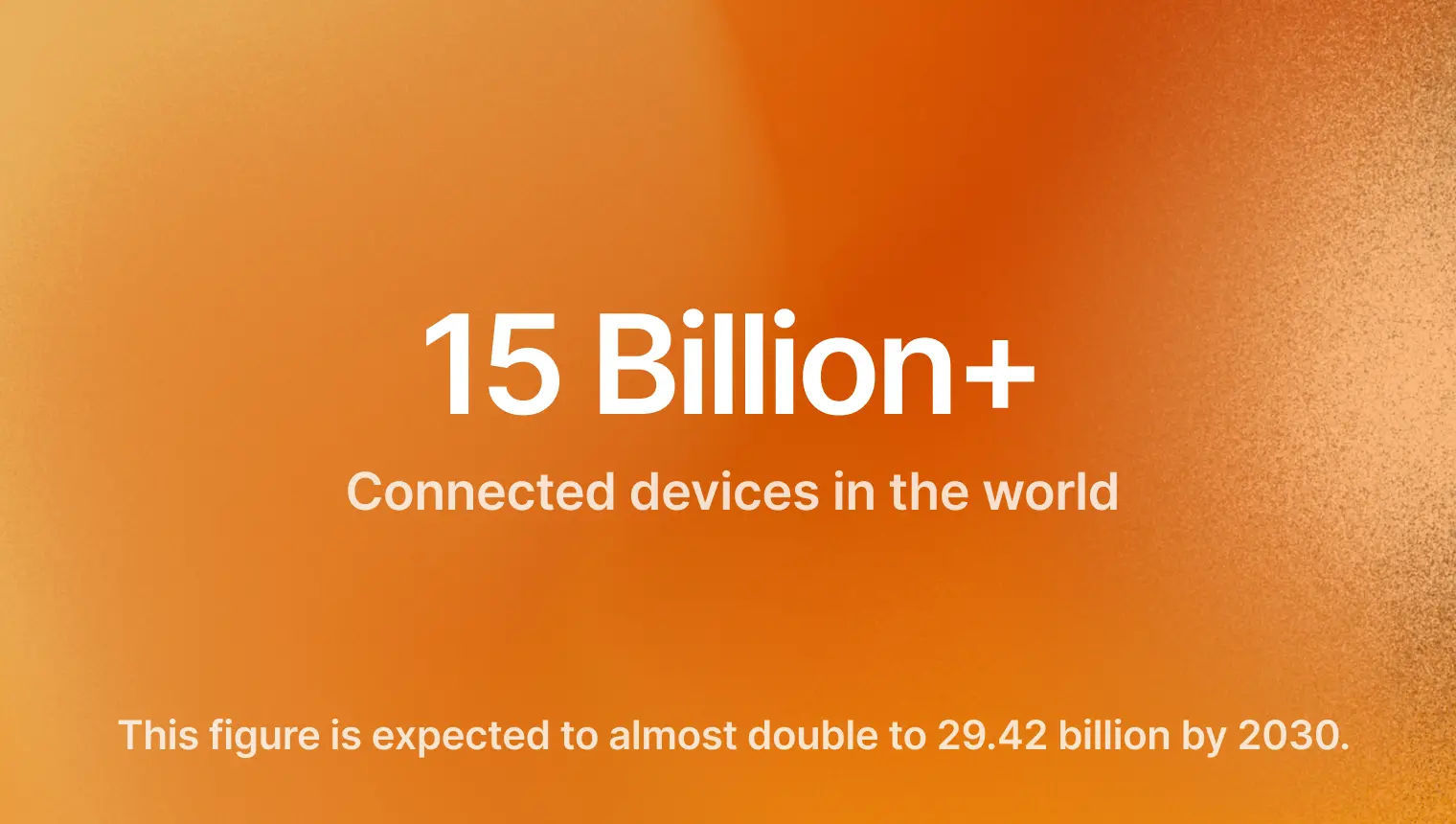

More than 15 billion. That's the estimated number of connected devices in the world. These objects are collecting and communicating a vast amount of data of all kinds in real time: a goldmine for anyone able to analyze and interpret it.

The Internet of Things (IoT) could revolutionize many sectors of the economy, including insurance. Let's take a look at the potential of this technology and the pitfalls it will have to overcome.

Source: Exploding Topics

Preventing risks rather than repairing losses

For now, insurance companies are using the IoT mainly to facilitate interactions with customers and to simplify underwriting and claims processing. However, the data collected from connected objects could be useful in a number of ways:

- Reforming pricing models, particularly by basing them on behavior.

- Improving the customer experience by offering new products and partnerships.

- Prevent claims.

- Improve management, particularly of corporate fleets.

- Offering new insurance products, for example in the field of cyber security.

- Speed up processes.

- Assessing natural and environmental risks.

- Fight against fraud.

The development of the IoT would not only benefit customers, but also insurance companies. This technology would allow them to generate additional revenue while reducing costs.

According to the audit and consultancy firm Deloitte, the use of data from connected objects could help insurance companies change their approach. These companies have evolved through a defensive posture: spreading risk among their customers to compensate for losses. The IoT could enable them to be more proactive by helping customers prevent damage, thereby avoiding claims and losses.

What IoT can change in insurance

Reforming pricing models

Why should an occasional, careful driver pay the same amount for insurance as someone who drives a hundred kilometers every day in heavy traffic? The risks are not the same. Current models are based on data that insurance companies can easily request, such as demographics (location, age, etc.). Access to data from connected vehicles would allow them to set premiums according to new criteria. They could also reward good practices by offering discounts to certain policyholders.

These new insurance contracts could be based on many criterias:

- The number of kilometers driven,

- How often the vehicle is used,

- The driver's tendency to brake hard,

- The speed at which the vehicle is driven

- And event the emotions he expresses while driving (aggressive driving, tendency to honk, etc.).

Prevent claims to improve customer experience

In the current model, the relationship between insurance companies and their customers is most often established through an intermediary (such as a broker) and is limited to renewals or claims.

The use of IoT would allow for a profound change in this relationship, multiplying the number of contacts and, above all, making them more positive. "Hello, the sensors in your water pipes report a leak. Do you want us to call a specialist to prevent further damage?" The insurer who relies on technology would no longer be the person you turn after a negative event, but would become an advisor to prevent damage.

Facilitate fleet management

Many companies have a fleet of vehicles, all of which are covered by insurance. The larger the fleet, the more difficult it is for its managers to know the location and condition of each vehicle. IoT makes it possible, among other things, to anticipate problems that could arise from poor maintenance.

In fact, we've already developed a fleet management application at Hyperio:

Better protection through new cyber insurance products

IT security is an increasingly important issue for businesses. Sensors placed in their networks could detect suspicious activity and automatically send an alert to a cybersecurity company, limiting the damage.

Speed up the process

Disaster can be a traumatic experience for victims. Getting their claim settled quickly allows them to move on with their lives. With connected sensors, their insurance company might be able to understand what happened better - and faster. This data would speed up the process.

Agricultural risk assessment

With climate change, extreme weather events will increase. By monitoring weather or soil conditions and other environmental factors, we can anticipate potential disasters. Data analysis would allow preventive measures (human, automatic or autonomous) to be taken to limit damage.

Several hurdles remain

Reduced premiums in exchange for data captured by your connected objects? Sounds like an enticing offer. For a long time, the majority of policyholders seemed to resist these kinds of products. The tendency is now reversing, according to a survey lead by Sollers Consulting in collaboration with polling organization IPSOS . Usage-based models would even be approved by 51% of policyholders.

For sure, it will take more than financial arguments for insurance companies to convince their customers of the benefits of IoT. Other factors will come into play to make this new type of product attractive:

- Offering value-added services, such as discounted rates from partner providers. For example, the insurance company could warn drivers of road hazards or poor traffic conditions, or automatically alert them to the condition of their vehicle by directing them to the nearest partner repair shop;

- Reward good practices, using gamification to build community and increase peer pressure;

- Demonstrate their ability to manage and store data transparently to build trust. This is likely to require a major overhaul of their internal processes;

- Need to reassure the public about data privacy, in particular by putting in place security and control processes.

Final Thoughts

Ultimately, IoT has incredible potential in the insurance industry. In the worst-case scenario, this technology will improve and speed up processes, particularly claims handling.

On the other hand, if insurers are able to build trust in using technology to improve their services, it could revolutionize the role of insurance in helping to anticipate claims. They will no longer be the people you turn to when you have to deal with traumatic events. Instead, they will become a trusted partner offering advice on how to limit risks... and lower premiums.

Related articles

LoRaWan, an ideal technology for prototyping applications for the Internet of Things

Nemo, a tailor-made AI for companies and public authorities

Liked this article?

Share it with the world!

Contact us

Lets' get in touch

Are you looking for a partner to realize your ambitions? Hyperio specializes in delivering tailored software solutions, IT consulting, and digital transformation services to help your business thrive.